Inventory and Appraisement in a Divorce

In Texas, property is divided in a “just and right” manner. In order for the Court to determine what is just and right, the Court needs to see what the community estate is made up of.

What is the Community Estate?

The community estate is everything you and your spouse incurred from the date of marriage to the date of divorce. Every asset or liability that has been accrued, whether it’s in a spouses sole name or held jointly, is part of community estate. Separate property – property that was owned prior to marriage or property that was received through inheritance or gift – is not a part of the community estate.

What is an Inventory and Appraisement?

The easiest way for the Court to see the make-up of the community estate is through an Inventory and Appraisement. The Inventory and Appraisement takes all of the community’s assets and liabilities and puts them into one place.

- Assets are property with a positive value: the value of your home, bank accounts, investment accounts, retirement accounts, business interest, or vehicles.

- Liabilities are negatives: a mortgage, credit cards, vehicle loans, tax liabilities or personal loans.

The easiest way to prepare an Inventory and Appraisement is with an Excel sheet. An Excel sheet allows for ease when the Judge divides assets and liabilities or when parties are negotiating during the settlement phase of the case.

How Does the Court Divide the Community Estate?

Contrary to popular belief, the Court does not divide every single item in the community estate 50/50. It would not be practical for the Court to split every single item in half. Rather the Court uses offsetting to divide the estate. When dividing the community estate, the Court divides the net of a community’s estate. The net means that the Court divides the difference in the assets and liabilities in a just and right manner.

Depending on your community estate, the net could be positive or negative. A positive net means that your assets outweigh your liabilities.

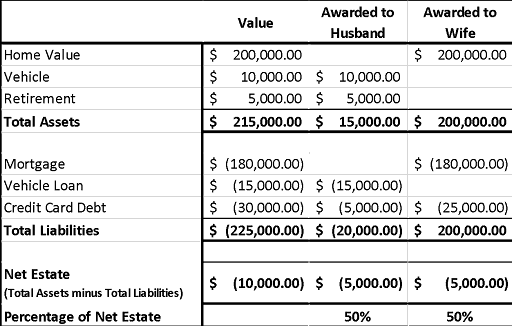

Negative Net

A negative net means that your liabilities outweigh your assets. This negative net would leave the community’s estate is in the red (negative) and the Court has no choice but to divide debt. An example of this is below:

Positive Net

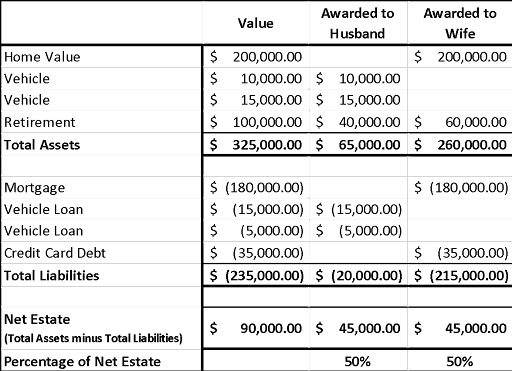

It could be the case that your community estate is positive. Again, we don’t divide every single asset 50/50 as it would not be practical. The offsetting tool is used to attempt to keep assets together.

Swing Account

In most circumstances, a swing account is used. A swing account is an account that is used to make the division equal. In the example below, the swing account that is used is the retirement account:

The Importance of the Inventory and Appraisement

You can see how the Inventory and Appraisement assists in ensuring that the net estate is equally divided. Sometimes this means that a Party walks away with more assets than the other Party, but that Party who takes more assets also takes on more liabilities (debt). In the example above, the Wife is awarded $260,000 worth of assets, however she also takes the mortgage ($180,000) and credit card debt ($35,000). Her net is still the same as Husband, even though he walked away with less assets and less debt.

To determine what is best for you and your family, contact a knowledgeable attorney from Hunt Law Firm to discuss your specific situation.

Skilled Litigators & Counselors At Law

WHAT ELSE MAKES OUR FIRM UNIQUE?

-

Quick Response Time

You can almost always expect a call back in 24 hours, with most being returned the same day.

-

One-on-One AttentionYou can always count on receiving personalized attention from our small, boutique firm.

-

Compassionate & Honest

You'll get an attorney who is compassionate, receptive, and responsive to your needs.

-

Cost-Effective Firm

We utilize the latest technology to reduce costs, including access to an online client portal.

Testimonials

WHAT OUR CLIENTS SAID ABOUT US

-

"Responsive, Informative, and Caring"Mr. Hunt was responsive from the start, replying to my initial inquiry questions on a Sat/Sun. My case had urgency, and the staff got my case started right away. Brittany took time to explain the priority and timelines for information they needed from me.Tammy

-

"Top-notch professionalism and quality."Hunt Law Firm, PLLC is top-notch. I've used them for over 3 years and can't say enough about their professionalism and quality of work.Wyatt

-

"Patience, respect, and complete professionalism."I found a law firm that really cares! From the first call to set an appointment to the signing of my prepared estate planning documents, I was treated with patience, respect, and complete professionalism.Cherry

-

"Absolutely wonderful team."Hunt Law Firm, PLLC, is absolutely wonderful. I'll be recommending this amazing firm to everyone in the future.Rifath

-

"Working with the Hunt Law Firm made our estate preparation seamless."Right from the initial consultation meeting, to the final signing, the entire staff provided the needed support to accomplish our objectives.Kola

-

"Fantastic, friendly, and efficient service!"Fantastic, friendly, and efficient service! They did exactly what we needed in a very professional way. Would definitely recommend Hunt Law Firm, PLLC for estate planning.Fran