Katy Child Support Attorney

Compassionate Advocacy for Your Family

When a family is facing divorce, emotions can run high, and having to deal with complex legal issues only adds more stress and uncertainty to an already difficult situation. Hunt Law Firm provides ethical and responsive representation for children and families in the greater Houston area.

Our family law firm guides each client and his or her family with sound and responsive legal support from the beginning to the end of each case. Our Katy child support lawyers will listen to your situation and deliver honest, receptive counsel so you are aware of all aspects of your child support issue.

Hunt Law Firm represents clients in child support matters, including:

- Creation of child support orders

- Enforcements

- Contempt issues

- Modifications

If you need help navigating the child support process, reach out to our child support attorneys in Katy by calling (832) 781-0320 today to discuss your situation.

On This Page:

- Understanding the Importance of Child Support

- Establishing a Child Support Order in Texas

- Can I Get Back Child Support?

- How Do I Get the Other Side’s Income Information?

Child support is a legal obligation that ensures the financial well-being of a child whose parents are separated or divorced. It aims to cover various expenses, including medical care, education, housing, and other essential needs. Establishing a child support order not only provides stability for the child but also helps maintain a fair and equitable distribution of financial responsibilities between parents.

Navigating the legal aspects of child support can be a challenging and complex process. Whether you're a custodial parent seeking financial assistance for your child or a noncustodial parent aiming to fulfill your financial obligations, understanding how to establish a child support order is crucial.

To initiate the child support process in Texas without an attorney, you may reach out to the Child Support Division of the Texas Attorney General's Office. They will provide guidance and assistance throughout the process. There will be an application and a waiting period before the Office of the Attorney General opens your case and notices the other parent of the new case.

A much quicker and perhaps efficient way to begin the process however is to file a petition in the county the child has resided in for the last six months.

If the child's biological father is not listed on the birth certificate, establishing paternity is a crucial step in the child support process. This can be done voluntarily or through legal means such as genetic testing. Contact the Texas Attorney General's Office or consult an attorney for guidance on establishing paternity. This can be done within the child support lawsuit.

After receiving the child support application, the Texas Attorney General's Office will schedule a hearing. Both parents will receive notice of the hearing, which will outline the date, time, and location. It is important to attend the hearing and present any relevant evidence or documentation to support your case.

If you have filed into the court yourself, you can set a temporary orders hearing or a final trial.

A former Harris County Judge used to tell the litigants in his courtroom, “The only thing for certain in life are death, taxes, and child support.” This may not be a pleasant thought, however the saying rings true. Unless parties agree to not give or receive child support, one parent is inevitably always going to pay child support. The question then becomes, how do you calculate the child support amount?

In Texas, the child support formula determines the noncustodial parent’s amount of child support based on:

- The number of children in the suit

- Any children not in the suit

- The noncustodial parent’s net income

The Texas Family Code has specific guidelines to calculate and determine a child support obligation. One of the easiest ways to determine child support is through the Office of the Attorney General’s Child Support Calculator. However, this calculator does not consider all the nuances of the Texas Family Code. To ensure accuracy, familiarize yourself with the law.

Calculating Child Support in Texas

One of the most common questions parents ask when facing a divorce is "how much will child support be?" This is a sensitive consideration that needs to ensure the well-being of all the involved children and, in Texas, there are specific calculations the court will use to determine appropriate child support payments.

Below, we take a closer look at these formulas and the special considerations that sometimes apply in these determinations.

The term “child” refers to anyone under the age of eighteen, a child who is eighteen but has not graduated from high school, or a disabled child.

Your first step in determining child support is to figure out how many children the Obligor has in the suit at hand. An Obligor is the individual who pays child support. In the current lawsuit, you must determine how many children the Obligor has and then, if the Obligor has any other children that are not part of this lawsuit.

Family relationships can oftentimes be complex. An Obligor may have a child with multiple individuals. It is important to always ask the Obligor how many children he or she may have, and when you do – it may surprise you!

Next you will determine an Obligor’s resources. When feasible, you want to compute these resources on an annual basis instead of monthly.

So what are considered “resources?”

An Obligor’s resources may include many different things, such as:

- Earned Income: Earned income constitutes the most basic form of income that is considered for child support calculations. It includes wages, salaries, tips, and any other compensation received through employment. This income is typically documented through pay stubs or tax returns, providing a clear picture of the parent's earning capacity.

- Self-Employment Income: For individuals who are self-employed or own a business, determining income for child support can be more complex. In such cases, the court will usually consider the parent's gross income, which encompasses revenues minus ordinary and necessary business expenses. Documentation such as tax returns, profit and loss statements, and bank statements can help establish self-employment income.

- Unemployment Compensation: Unemployment compensation received by a parent who is out of work may be factored into the child support calculation. However, it's important to note that if a parent voluntarily remains unemployed or underemployed, the court may impute income based on the individual's earning capacity.

- Investment Income: Income from investments, such as dividends, interest, and rental properties, is typically included when calculating child support. The court will consider the actual income received from investments, as well as impute income if it determines that the parent has the ability to earn more from these sources.

- Bonuses, Commissions, and Overtime: Additional forms of income, such as bonuses, commissions, and overtime, are generally considered for child support calculations. These types of income may fluctuate, but the court can average them over a specific period to determine a more accurate representation of the parent's earning capacity.

- Retirement Benefits and Social Security: Retirement benefits and Social Security income, including disability benefits, can also be counted as income for child support purposes. These sources of income are typically included when assessing the parent's ability to contribute financially to the child's needs.

Child support calculations in Texas may also account for other sources of income, such as:

- Annuities

- Capital gains

- Disability and workers' compensation benefits

- Gifts and prizes

- Interest income from notes regardless of the source

- Pensions

- Royalties

- Severance pay

- Spousal maintenance and alimony

- Trust distributions

- United States Department of Veterans Affairs disability benefits other than non-service-connected disability pension benefits, as defined by 38 U.S.C. Section 101(17)

These additional income streams are evaluated based on their nature, amount, and regularity to determine their relevance in the child support calculation. As you can see the list of resources is highly exhaustive. If an Obligor receives multiple types of resources, they are added together and accumulated to determine the total amount of resources an Obligor has.

There are certain items that are not considered in calculating an Obligor’s resources. This includes:

- Return of principal or capital;

- Accounts receivable;

- Supplemental Security Income (SSI)

- Benefits paid in accordance with the Temporary Assistance for Needy Families (TANF) program or another federal public assistance program; or

- Payments for foster care of a child.

That means if an Obligor receives any of the items listed above, they are not included in calculating resources. Due to the complexity of these calculations, it is best to speak to an attorney who can help you understand whether these other sources may count as income.

Once you have determined the total resources an Obligor has available, the next step will be to determine the total Deductions available. It is important to note these Deductions should also be computed on an annual basis.

The following items will be deducted from an Obligor’s resources:

- Social security taxes;

- Federal income tax based on the tax rate for a single person claiming one personal exemption and the standard deduction;

- State income tax;

- Union dues;

- Expenses for the cost of health insurance, dental insurance, or cash medical support for the children in this suit; and

- If the Obligor does not pay social security taxes, nondiscretionary retirement plan contributions.

Annual Resources less Annual Deductions will provide you with the Total Annual Net Resources.

To finalize this amount, you will subtract the number of determined deductions from the number of calculated resources. This gives you the Total Annual Net Resources an Obligor has available.

Once the Obligor's total net resources are determined, as well as how many children are in the current suit, a certain percentage of that income will be ordered as child support.

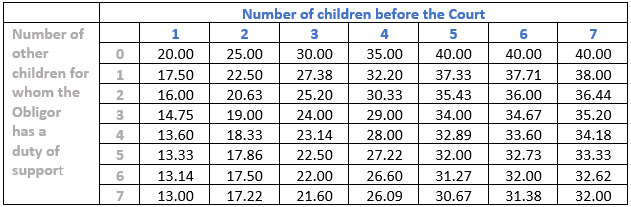

The chart below will assist you in determining the percentage to be paid:

The X-axis lists the number of children before the court (the number of children in the current lawsuit). The Y-axis lists the number of other children the Obligor has a duty to support. To determine what percentage an Obligor will pay, follow the X-axis and Y-axis until they meet. This will give you the percentage of child support to be paid.

Some examples include:

- 1 Child before the Court; No other children = 20.00%

- 2 Children before the Court; No other children = 25.00%

- 2 Children before the Court; 2 other children = 20.63%

- 4 Children before the Court; 1 other child = 32.20%

Once the Total Annual Net Resources has been calculated, multiple this number by the percentage of child support an Obligor must pay. Once this has been complete, you will have the Total Annual Child Support Obligation to be paid.

When you receive the Total Annual Child Support Obligation, dividing that number by twelve will provide you with the monthly obligation the Obligor must pay for child support.

There are a few special considerations that may not apply to every divorce case but can still have a significant effect on a child support calculation. First, it's important to understand that there's an income cap on these calculations: only up to $9,200 of a parent's net monthly income can be used for these calculations.

The court will also take into consideration any pre-existing child support orders the providing parent may be under. If the parent is already providing child support to other children from another marriage or relationship, the court may lower the percentage of the net monthly income ordered in the new child support order.

Finally, it is important to note that while these guidelines apply to most child support situations, the court can adjust the amount if it would be in the child’s best interest because the child has needs above the guideline amounts.

As of September 1, 2021, there are different child support guidelines for noncustodial parents whose monthly net resources are less than $1,000.

The new support payments laws are as follows:

- For one child, support is 15% of net income;

- For two children, 20%;

- For three children, 25%;

- For four children, 30%;

- For five or more children, 35%.

Once the court has made a decision, you will receive a proposed child support order, either from your attorney, or the Office of the Attorney General. Carefully review the order to ensure all details are accurate.

Sometimes a child support order will also outline who carries and pays for the child’s health insurance.

The court will order that child support be paid through the State Disbursement Unit most likely with a wage garnishment. It is the obligation of both the custodial and noncustodial parent to update the Office of the Attorney General as to address changes and any change in income of the Obligor parent.

Retroactive child support, also known as “back child support,” can be ordered when the parents have separated and the non-custodial parent did not financially support the custodial parent and the child in the months between the separation and the date the court makes the first order in the custody case or divorce.

Typically, we must prove that the payor knew about the child and still failed to provide financially. In some cases, the judge will even order the payor to reimburse the other parent for pre- and post-natal medical expenses if the payor was not financially supporting the other parent during the pregnancy.

Once a divorce involving children or a custody case begins, both sides are required to exchange paystubs, W-2 forms, tax returns, and bank statements. This rule allows both sides to operate from the same set of information and helps eliminate some of the most common issues that come up in cases like this.

If a parent is attempting to hide income in order to lower their child support amount, we have several tools available to us. The most common tool used is the Discovery process. This process allows us to obtain information and documents from the other side as well as directly from their employer or bank. It is becoming increasingly common for people to exclusively or primarily use payment apps like CashApp or Venmo or even cryptocurrency to conduct transactions and receive payments. So, Discovery allows us to obtain documentation from various sources to help establish the payor’s true financial situation so that we can get the child support set at the proper amount for our client’s children.

Contact Hunt Law Firm to Discuss Your Situation

The goal at Hunt Law Firm is to help families like yours focus on what is most important—the well-being of your child. Our child support lawyers in Katy can help you complete and file all necessary paperwork to start or modify child support. We handle every single case with a responsive attention to detail. Because Hunt Law Firm is smaller, we are able to provide each client with personalized attention. Our clients can always expect receptive counsel, compassionate advocacy, and affordable fees.

Contact the firm today at (832) 781-0320 to learn more about our child support services or to schedule an appointment.

Recommended Reading

Skilled Litigators & Counselors At Law

WHAT ELSE MAKES OUR FIRM UNIQUE?

-

Quick Response Time

You can almost always expect a call back in 24 hours, with most being returned the same day.

-

One-on-One AttentionYou can always count on receiving personalized attention from our small, boutique firm.

-

Compassionate & Honest

You'll get an attorney who is compassionate, receptive, and responsive to your needs.

-

Cost-Effective Firm

We utilize the latest technology to reduce costs, including access to an online client portal.

Testimonials

WHAT OUR CLIENTS SAID ABOUT US

-

"Responsive, Informative, and Caring"Mr. Hunt was responsive from the start, replying to my initial inquiry questions on a Sat/Sun. My case had urgency, and the staff got my case started right away. Brittany took time to explain the priority and timelines for information they needed from me.Tammy

-

"Top-notch professionalism and quality."Hunt Law Firm, PLLC is top-notch. I've used them for over 3 years and can't say enough about their professionalism and quality of work.Wyatt

-

"Patience, respect, and complete professionalism."I found a law firm that really cares! From the first call to set an appointment to the signing of my prepared estate planning documents, I was treated with patience, respect, and complete professionalism.Cherry

-

"Absolutely wonderful team."Hunt Law Firm, PLLC, is absolutely wonderful. I'll be recommending this amazing firm to everyone in the future.Rifath

-

"Working with the Hunt Law Firm made our estate preparation seamless."Right from the initial consultation meeting, to the final signing, the entire staff provided the needed support to accomplish our objectives.Kola

-

"Fantastic, friendly, and efficient service!"Fantastic, friendly, and efficient service! They did exactly what we needed in a very professional way. Would definitely recommend Hunt Law Firm, PLLC for estate planning.Fran